Depreciation expense formula

Calculate the depreciation expense of Ali for the year ended 2019 using the straight-line method. This is usually the deduction multiplied by the tax rate.

How To Calculate Depreciation

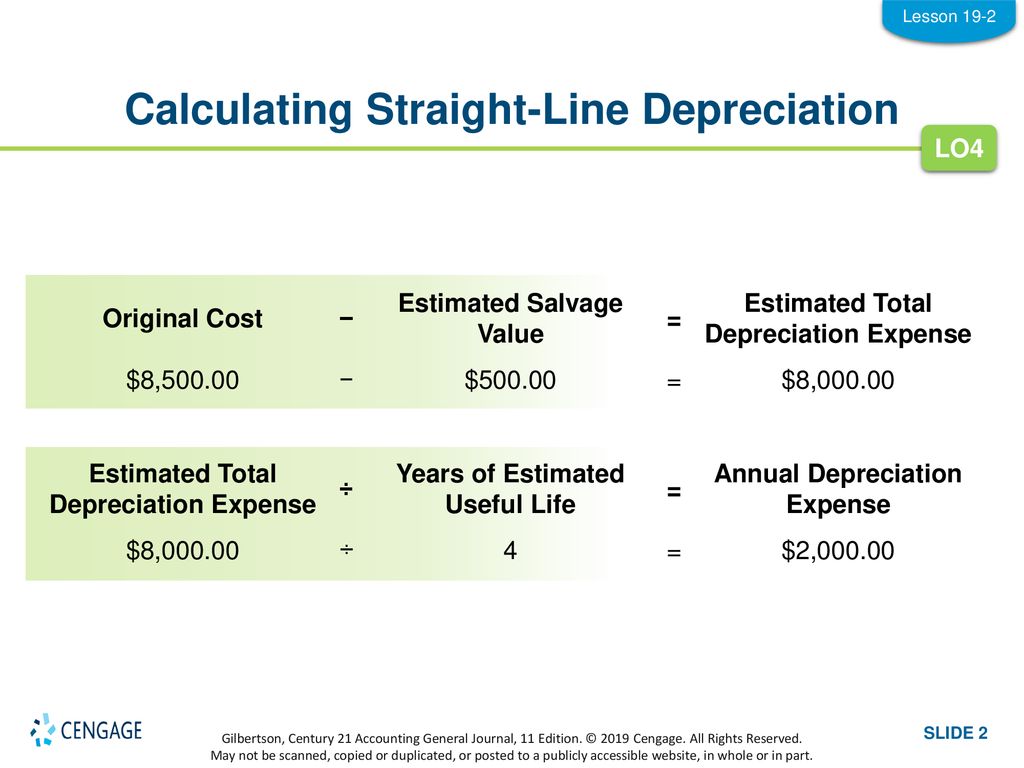

It represents the depreciation expense evenly over the estimated full life of a fixed asset.

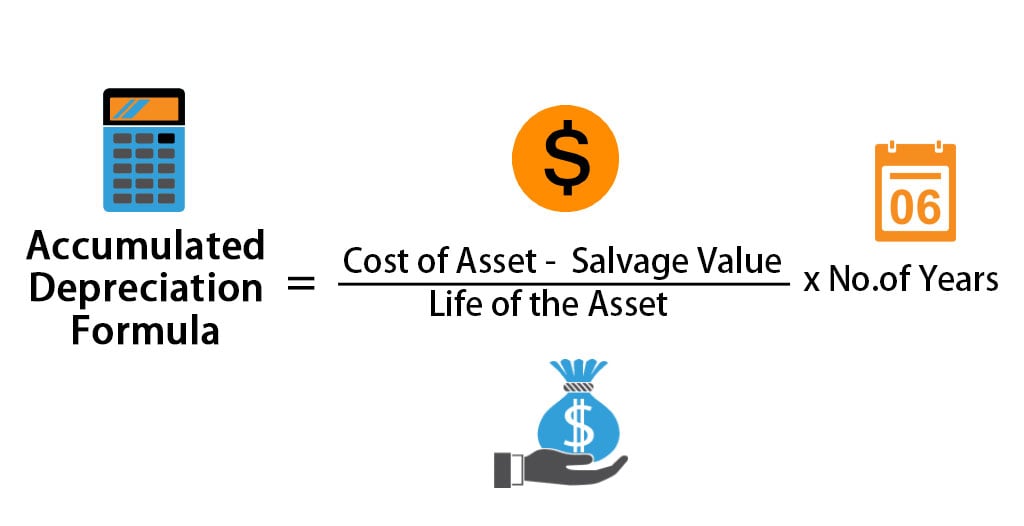

. Since depreciation is a non-cash expense and tax is a cash expense there is a real-time value of money saving. The accumulated depreciation is the gross amount of depreciation expense allocated to a specific asset since it was started using. Totally there are 20 Units of equipment.

Businesses depreciate long-term assets for both tax and accounting purposes. Furthermore depreciation is a non cash expense as it does not involve any outflow of cash. Price of acquiring the printer 500 - approximate salvage value 50 450.

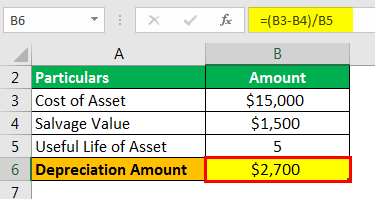

And life for this formula is the life in periods of time and is listed in cell C4 in years 5. For tax purposes. Depreciation is the accounting process of converting the original costs of fixed assets such as plant and machinery equipment etc into the expense.

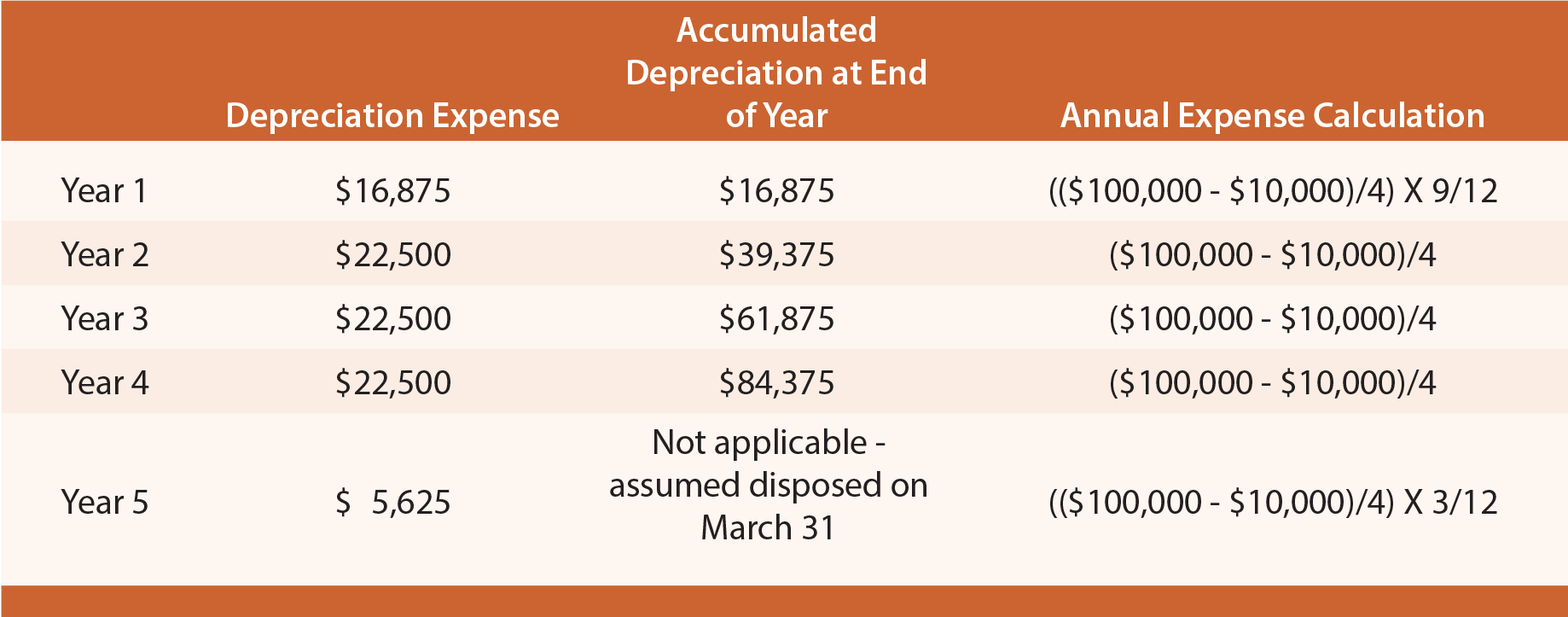

Once you have the yearly accumulated depreciation you can also calculate depreciation by month quarter or another fiscal time period. The formula for calculating annual depreciation through SLM is. Read about the depreciation formula and Expense.

Depreciation Tax Shield is the tax saved resulting from the deduction of depreciation expense from the taxable income and can be calculated by multiplying the tax rate with the depreciation expense. Applying the formula So the manufacturing company will depreciate the machinery with the amount of 10000 annually for 5 years. To increase cash flows and to further increase the value of a business tax shields are used.

To find the monthly accumulated depreciation using the above example convert the annual depreciation into months by dividing by 12. If the above copier has a useful life of five years. 150 is the expected annual straight-line depreciation expense of the new printer.

Operating Expense Formula Sales commission Rent Utilities Depreciation 10 5 5 8 million. The basic difference between depreciation expense and accumulated depreciation lies in the fact that one appears as an expense on the income statement depreciation and the other is a contra. Company X buys equipment for Rs7000 and the useful life of the machinery is 5 years and the Salvage value of the machinery is Rs4000.

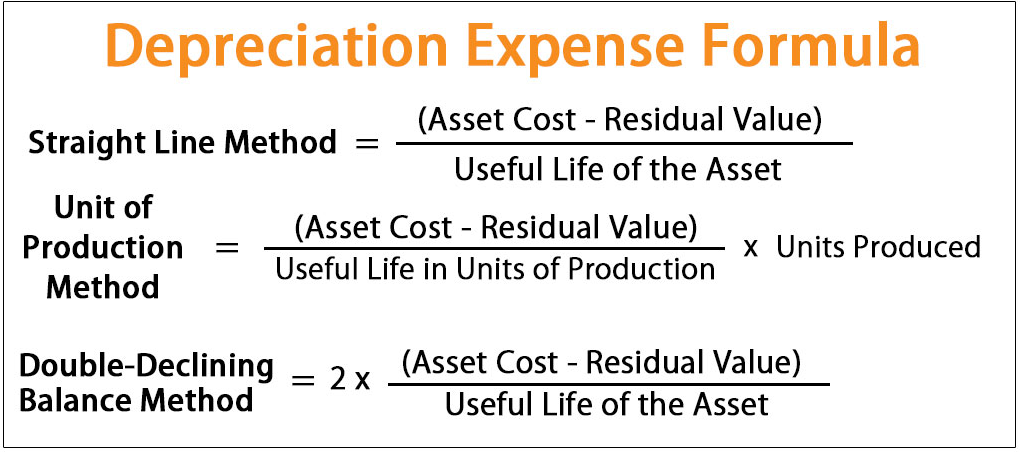

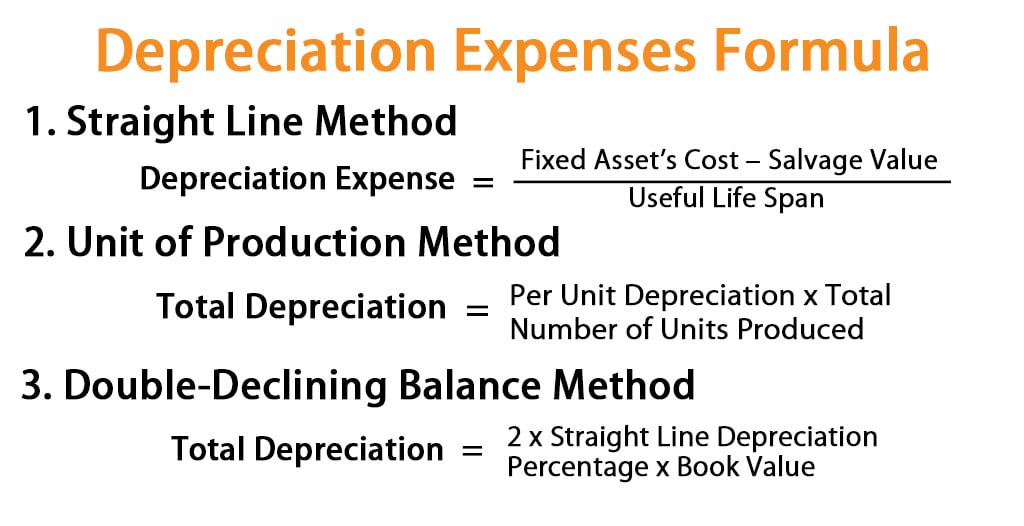

Some companies or organizations also use the double-declining balance method which results in a large amount of depreciation expense. Depreciation Expense 5000 3000 5. You can use a basic straight-line depreciation formula to calculate this too.

In case of straight-line depreciation calculation the amount of expense is the same for each year of the asset lifespan. Let have a look at the formula so you can understand it better. The effect of a tax shield can be determined using a formula.

It is computed by deducting OPEX such as salaries depreciation Depreciation Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. 20000 every year for a period of 5 years. The formula to calculate depreciation under SYD method is.

The cost is listed in cell C2 50000. Multiply the vans cost 25000 by 40 to get a 10000 depreciation expense in the first. As the name suggests the expense is calculated on a straight line.

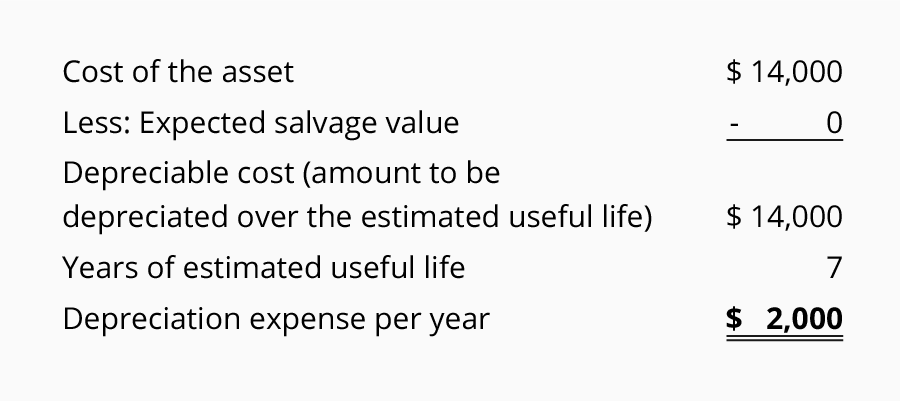

Companies using accelerated depreciation methods higher depreciation in initial years are able to save more taxes due to higher value of tax. 1 Years of useful life. Example of straight-line depreciation without the salvage value.

Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life. Depreciation is the gradual decrease in the book value of the fixed assets. Further it also offers a tax.

For the double-declining balance method the following formula is used to calculate each years depreciation amount. Stay tuned to BYJUS. The periodic depreciation is charged to the income statement as an expense according to the matching principle.

The company takes 50000 as the depreciation expense every year for the next 5 years. Lets say you want to find the vans depreciation expense in the first second and third year you own it. Investment Banking Financial Modeling Excel Blog.

450 divided by three three years of expected useful life of the printer 150. An example of Depreciation If a delivery truck is purchased by a company with a cost of Rs. Ali would charge 150 as a depreciation expense in the year 2019 2020 and 2021.

You can determine the annual depreciation rate of an asset with the following formula. How Depreciation Expense is Calculate by using straight line method. Costs Scrap Value Estimated Useful Life 500 503 150.

When using the straight-line depreciation formula an asset depreciates by the same amount each year. 100000 and the expected usage of the truck are 5 years the business might depreciate the asset under depreciation expense as Rs. We need to define the cost salvage and life arguments for the SLN function.

How to calculate depreciation in small businesses. Depreciation is an accounting method that spreads out the cost of an asset over its useful life. Depreciation Expense Cost of Asset-Residual Value Estimated life of Asset.

Depreciation expense is usually charged against the relevant asset directly. SYD depreciation depreciable base x remaining useful lifesum. The types of depreciation calculation owing to its methods are indicated below.

In other words the value of the annual depreciation is the portion of the fixed asset that has been used in revenue generation during the year. The values of the fixed assets stated on the balance sheet will decline even if the business has not invested in or disposed of any assets. Salvage is listed in cell C3 10000.

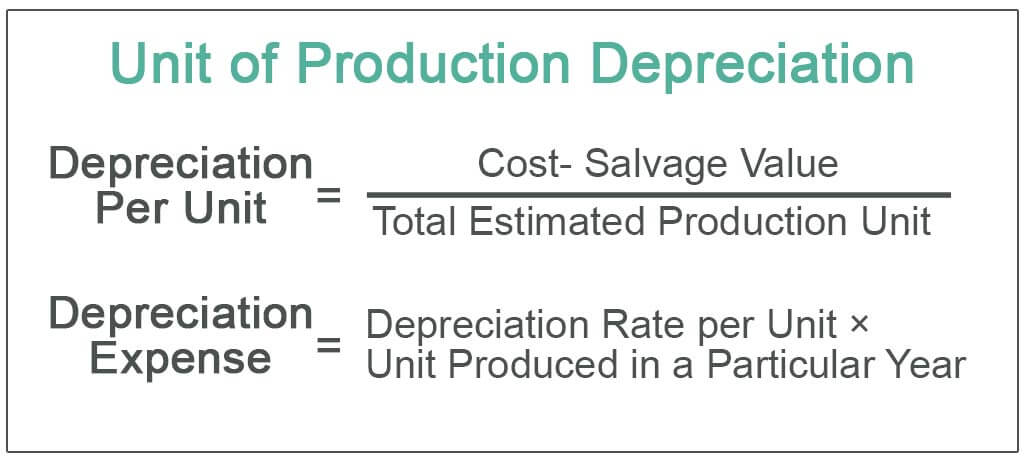

Depreciation Formula Table of Contents Formula. Double declining balance method is a type of diminishing balance method in which the depreciation. Depreciation Expense 4 2 -Unit of Production Method.

The depreciation amount changes from year to year using either of these methods so it more complicated to calculate than the straight-line method. Annual depreciation rate total useful lifetotal estimated useful life. Depreciation expense is the cost of an asset that has been depreciated for a single period and.

For example The original price of an asset is 5000 the estimated useful life is 5 years and the estimated net residual. To convert this from annual to monthly depreciation divide this result by 12. Divide annual depreciation to get monthly depreciation.

Depreciation Expense 2000 5. The business uses the following formula to calculate the straight-line depreciation of the printer. Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along.

Annual depreciation expense 60000 - 10000 50000. Depreciation Expense Rs. 11250 12 about.

It refers to the decline in the value of fixed assets due to their usage passage of time or obsolescence. Two methods are again used to record depreciation. FractextCost of Asset - Residual ValuetextUseful life of the asset.

The depreciation formula is.

Lesson 19 2 Calculating Depreciation Expense Ppt Download

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Calculation

Accumulated Depreciation Definition Formula Calculation

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Formula Calculate Depreciation Expense

Unit Of Production Depreciation Method Formula Examples

Depreciation Expense Calculator Hot Sale 57 Off Www Ingeniovirtual Com

Straight Line Depreciation Accountingcoach

Depreciation Methods Principlesofaccounting Com

Depreciation Expense Calculator Best Sale 57 Off Www Ingeniovirtual Com

Depreciation Expense Double Entry Bookkeeping

Depreciation Expense Calculator Hot Sale 57 Off Www Ingeniovirtual Com

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Calculate Depreciation Expense